Saving Money on Electrical, Plumbing, and HVAC Services with IRA Credits

The Inflation Reduction Act came into effect on January 1, 2023, offering tax credits and rebates to homeowners who choose to upgrade their homes to make them more energy-efficient. The savings are available to everyone, and savings for those in low- and middle-income brackets are even greater. If your home is over 25 years old, still has its original wiring, or its heating and plumbing systems aren’t operating efficiently, it’s probably time for equipment upgrades. With the IRA, these upgrades can be enjoyed by more people while fighting climate change with new, energy-efficient equipment.How the IRA Works

The IRA offers a range of incentives to homeowners who upgrade to more energy-efficient HVAC, electrical, and plumbing systems. Here’s how you can save:The HOMES Rebate

The Home Owner Managing Energy Savings (HOMES) program offers rebates ranging from $2,000 to $8,000, or up to 80% of a project, for people in low- and middle-income brackets. Those in high-income brackets can save $2,000 to $4,000, or up to 50%. Eligibility opens for these rebates if your upgrades cause you to cut energy usage by at least 20% to 35%.The HEEHRA Rebate

There are also special point-of-sale rebates available under a different provision called the High-Efficiency Electric Home Rebate (HEEHRA). Discounts up to $14,000 are available, as well as 100% of the costs of upgraded electrical systems for low-income homes and 50% for middle-income homes. To qualify for the biggest rebates, your annual income must be 150% below the median for your area.Tax Credits

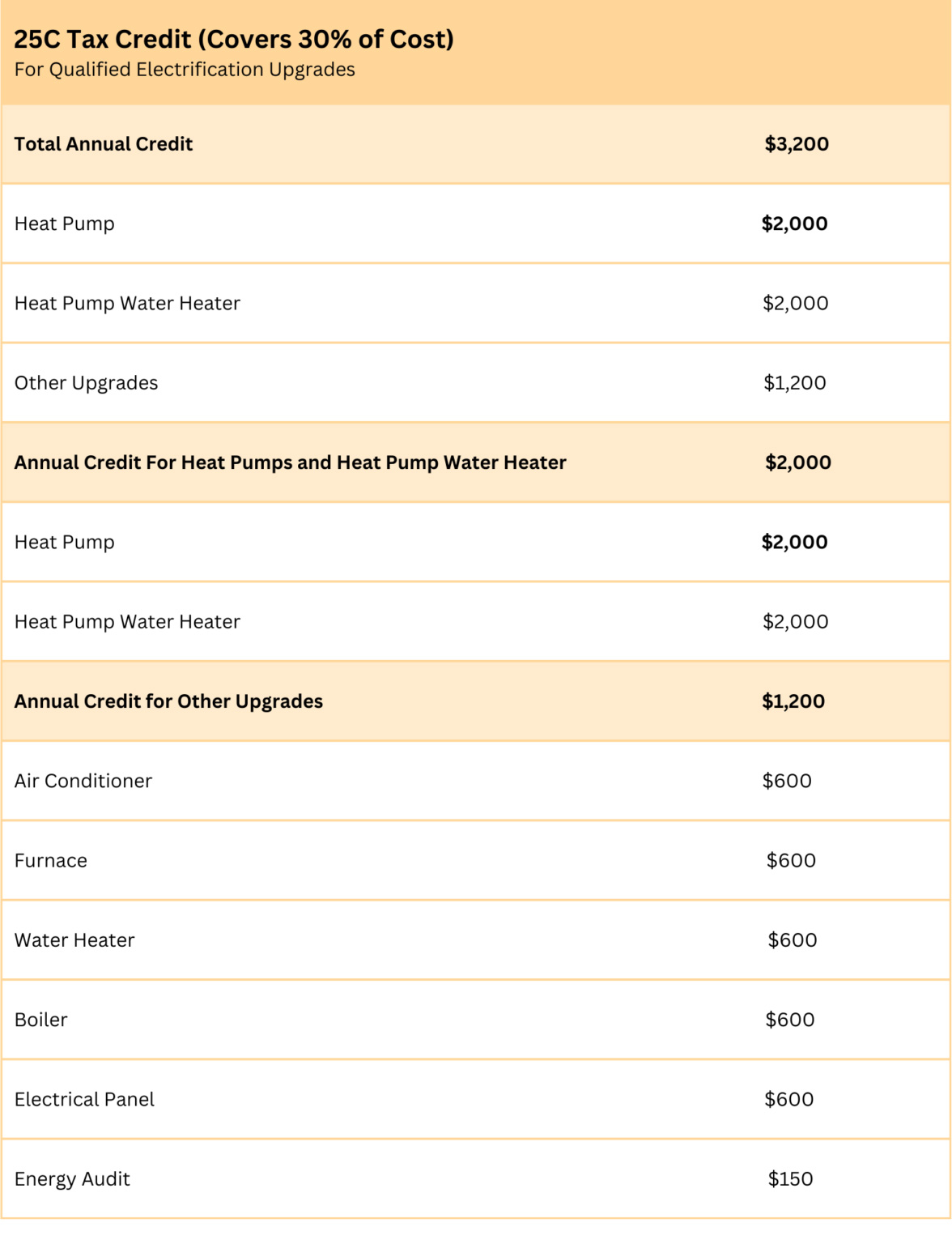

With the Energy Efficient Home Improvement Tax Credit, you can get up to 30% of the total cost of certain qualifying expenses as a tax credit. This means you can deduct up to 30% of energy-efficient upgrade costs from your federal income tax the next time you file, up to an annual limit of $3,200. Qualifying upgrades must adhere to the Consortium For Energy Efficiency and Energy Star requirements. Contact Wilmington Air today at 910-941-0399 to learn more details regarding the IRA and our expert HVAC, plumbing, and electrical services. Our team is ready to assist you in upgrading your home’s systems to save your health, your money, and the environment with energy-efficient equipment.

*Disclaimer: Wilmington Air does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. In addition, please note that the information provided by “brand name” regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. “Brand Name” is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.