How Can Inflation Reduction Act Tax Credits Benefit You?

Many tax credits can help you save money when tax season rolls around, but now there’s one that benefits the environment and homeowners who want or need to make specific electrical, HVAC, or plumbing repairs and upgrades. Inflation Reduction Act Tax Credits promote reduced carbon usage, so now Wilmington, NC, area homeowners can save money when making energy-efficient repairs or installing energy-efficient appliances.

How You Can Save Money on Home Repairs and Upgrades With the Inflation Reduction Act Tax Credits

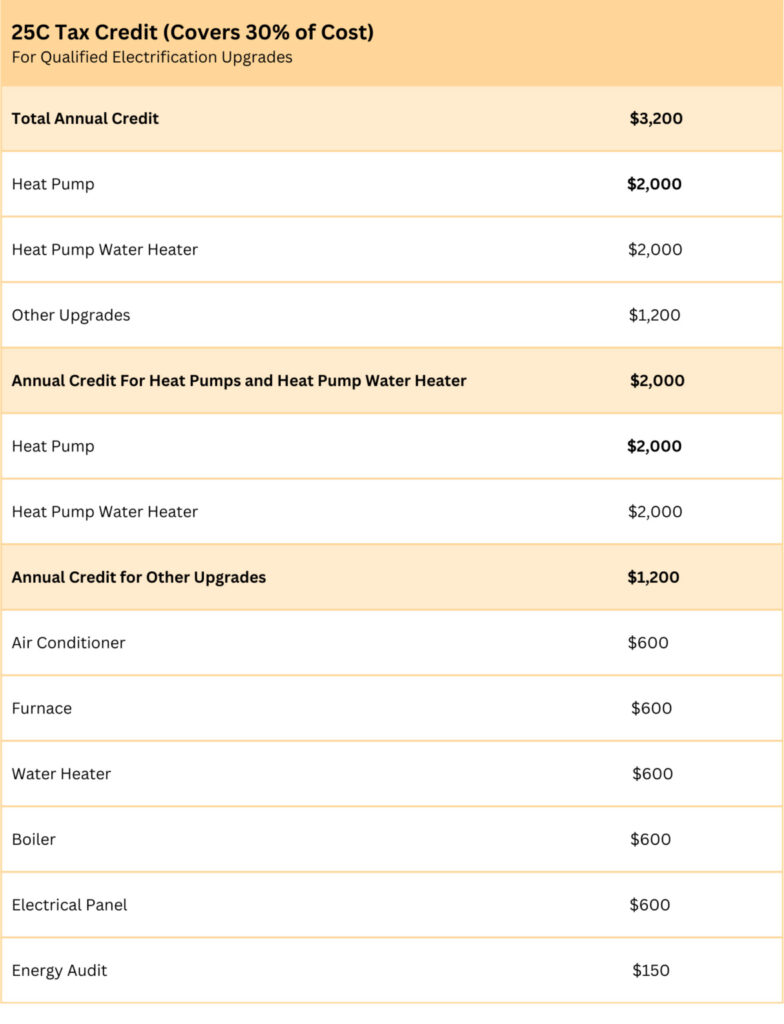

The 25C Energy Efficient Home Improvement tax credit allows for the deduction of up to 30% of the cost of your home improvement project, will reduce energy output and decrease carbon costs, capped at a maximum of $3,200 for the year.

What Type of Home Projects Qualify?

Electrical, HVAC, and plumbing projects and upgrades qualify for reimbursement under the Inflation Reduction Act tax credits. The act provides credits for replacing an older heat pump, heat pump water heater, air conditioner, water heater, furnace, boiler, or electrical panel with a more efficient option. It also covers an energy audit. These savings allow you to receive credit for the totality of the work, including the labor, the costs of the equipment, and any installation fees.Saving Money With Rebates

The IRA allows homeowners to benefit from other incentives through the High Efficiency Electric Home Rebate Act, also known as the HEEHRA, which provides reimbursements for low to mid-income homeowners. Those who qualify within a certain tax bracket can save up to $14,000 yearly, with rebates covering up to 100% of the costs of specific projects that make their home more energy efficient. The HEEHRA savings include weatherizing projects that better insulate, vent or seal the home and different electrical projects, including repairs, upgrades, and replacements.Saving Money by Reducing Energy Use

The Home Owner Managing Energy Savings (HOMES) rebate program is another aspect of the IRA specifically designed to incentivize reducing energy use. This rebate program is available for homeowners of all tax brackets, but those who qualify as low to middle-income homeowners will receive the most benefit. Those who reduce energy usage by up to 35% a year can save between $4,000 and $8,000.Saving Money on Energy Bills

One of the added benefits of taking advantage of these tax credits is that, once you make the necessary repairs and upgrades, you’ll have a more energy-efficient home and reap the benefits of significant energy savings reflected in your monthly energy bills. While the tax credits and rebates provide immediate savings, the reduced energy costs on your monthly bills provide long-term benefits that will last indefinitely. As with any tax credit, there are specific requirements that your upgrade or repair must meet to receive the full credit and maximum benefits. That’s where we come in. We can help you better understand the details of the IRA and how you specifically can benefit from it in one or more ways. Contact us today at Wilmington Air for more information.

*Disclaimer: Wilmington Air does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. In addition, please note that the information provided by “brand name” regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. “Brand Name” is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.